The Ultimate Guide to Audio Experience

Explore insights and reviews on the best audio gear.

Drive Smart, Save Big: Uncovering Auto Insurance Discounts

Unlock hidden auto insurance discounts and watch your savings grow! Drive smart and save big today with our expert tips.

Top 5 Auto Insurance Discounts You Might Be Missing

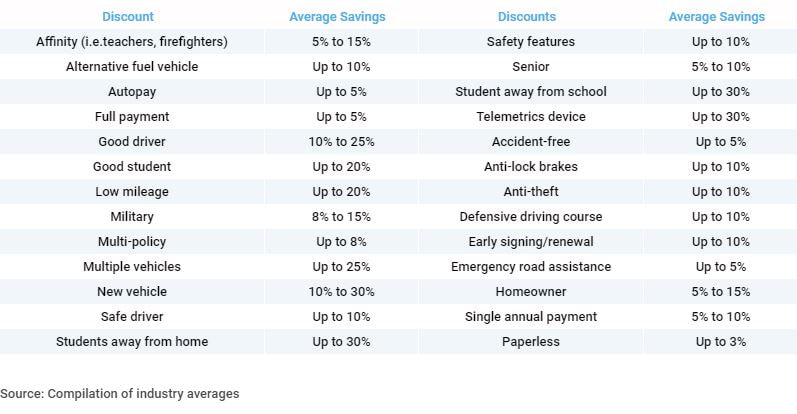

When it comes to auto insurance, many drivers overlook various discounts that can significantly lower their premiums. Understanding these discounts is crucial for maximizing savings. Here are the top 5 auto insurance discounts you might be missing:

- Bundling Discounts: If you have multiple insurance policies, like home and auto, bundling them can lead to substantial savings.

- Safe Driver Discounts: Maintaining a clean driving record can earn you discounts for being a responsible driver.

- Low Mileage Discounts: If you drive less than the average driver, your insurer may provide a discount for lower risk.

- Student Discounts: Students with good grades may qualify for discounts, encouraging responsible behavior.

- Usage-Based Insurance: Some insurers offer discounts for those who opt into telematics programs that track driving habits and reward safe driving.

How Safe Driving Can Significantly Lower Your Premiums

Practicing safe driving is not only essential for road safety, but it can also lead to significant savings on your insurance premiums. Insurance companies often reward drivers who maintain a clean driving record with lower rates, considering them to be less of a risk. By avoiding accidents, traffic violations, and other risky behaviors, you send a clear message to insurers that you’re a responsible driver. Safe driving can encompass a variety of habits including obeying speed limits, using seat belts consistently, and being mindful of your surroundings.

Moreover, many insurance providers offer programs that monitor your driving habits. These programs analyze factors such as braking behavior, acceleration patterns, and overall driving smoothness to assess your safety on the road. By participating in these initiatives, you can potentially qualify for additional discounts on your premiums. It's a win-win situation: you cultivate better driving habits while enjoying lower premiums. In conclusion, adopting a safe driving lifestyle not only protects you and others but also serves to bring down the costs of your auto insurance over time.

Are You Eligible for These Hidden Auto Insurance Discounts?

When it comes to saving on your auto insurance premiums, you might be surprised to find out that there are several hidden discounts that many insurers offer but fail to advertise. These can include discounts for safe driving records, bundling your policies, or even being a member of specific organizations. To ensure you are getting every possible discount, start by asking your insurance agent about any programs that may apply to you. Often, just a simple conversation can uncover savings you didn't know existed.

Additionally, consider exploring technical discounts offered for modern safety features in your vehicle. For instance, cars equipped with anti-lock brakes, airbags, and advanced driver assistance systems can qualify for significant reductions. Remember to keep your documentation handy when discussing with your insurer. Eligibility for these discounts can vary, but being proactive in seeking out and verifying them can lead to substantial savings over time.