The Ultimate Guide to Audio Experience

Explore insights and reviews on the best audio gear.

Buckle Up for Savings: Auto Insurance Discounts You Might Miss

Unlock hidden auto insurance discounts! Save big with tips you don't want to miss. Buckle up and start your savings journey today!

Unlock Hidden Savings: Auto Insurance Discounts You Didn't Know Existed

Finding ways to save on auto insurance can feel like a daunting task, but many drivers overlook the hidden savings available to them. One of the easiest ways to unlock these savings is through multi-policy discounts. Insurers often offer reduced rates when you bundle your auto insurance with other policies, such as homeowners or renters insurance. Additionally, if you belong to certain organizations, such as professional associations or alumni groups, you may qualify for exclusive discounts that further reduce your premiums.

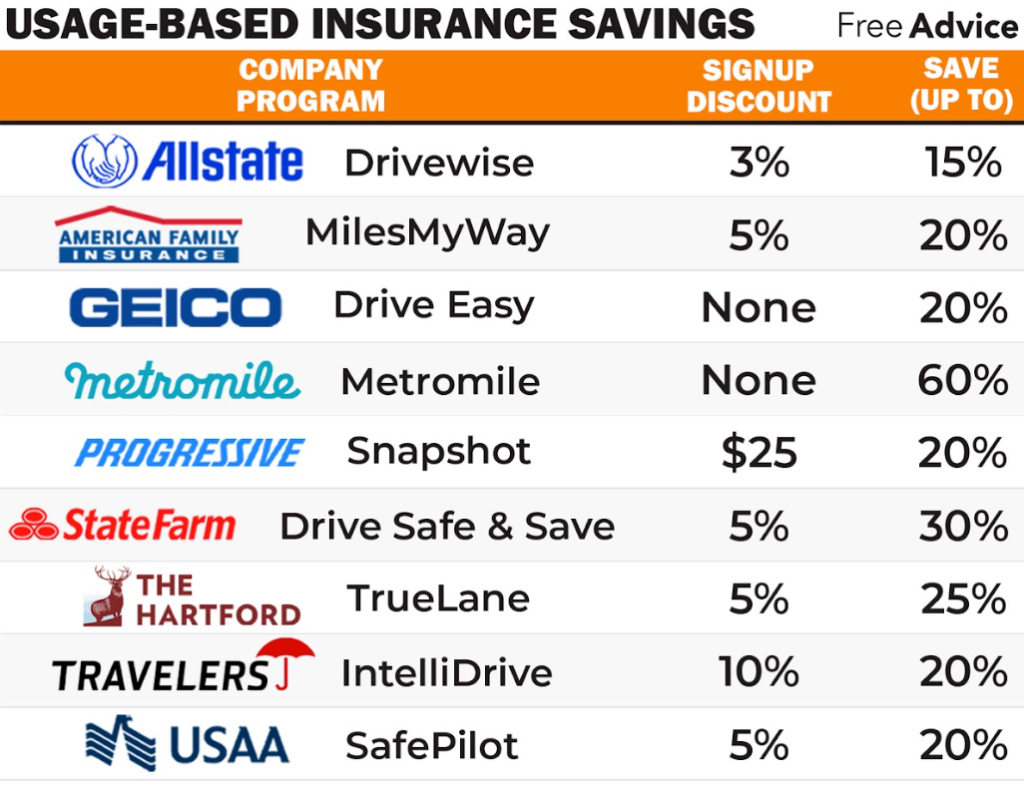

Another overlooked opportunity for savings comes from safe driving discounts. Many insurance companies provide significant reductions for drivers with clean driving records or those who complete defensive driving courses. Furthermore, utilizing technology can also lead to auto insurance discounts; some companies offer usage-based insurance, where your premium is based on driving habits. By monitoring your driving patterns through a mobile app or a device installed in your car, you can demonstrate safe driving behavior and earn lower rates over time.

Are You Missing Out? A Guide to Auto Insurance Discounts

Are you aware of the numerous auto insurance discounts that could significantly reduce your premium? Many drivers are missing out on potential savings simply because they aren't fully informed about the discounts available to them. Insurers often provide various incentives based on factors like driving history, vehicle safety features, and even your educational background. By taking the time to explore these options, you may discover eligibility for discounts such as:

- Safe driver discounts

- Multi-policy discounts

- Low mileage discounts

- Good student discounts

In addition to the common discounts mentioned above, there are also specialized options that can further enhance your savings. For instance, certain organizations and affiliations, like alumni networks or professional associations, may offer exclusive auto insurance discounts to members. Don’t forget to inquire about discounts for renewing your policy or for bundling your insurance with other types of coverage, such as home or renters insurance. If you haven't done so already, reach out to your insurer today to review your policy and explore the full range of discounts you might be eligible for. You could be leaving money on the table!

Maximize Your Savings: Common Auto Insurance Discounts Explained

When it comes to maximizing your savings on auto insurance, understanding the various discounts available can make a significant difference in your premium. Many insurance providers offer a range of discounts that cater to different lifestyles and circumstances. For instance, safe driving discounts are designed for policyholders who maintain a clean driving record, while multi-policy discounts reward those who bundle their auto insurance with other types of coverage, like homeowners or renters insurance. Additionally, completing a defensive driving course can also qualify you for a discount, reflecting your commitment to being a responsible driver.

Another way to maximize your savings is by taking advantage of discounts for low mileage. If you drive less than a certain number of miles per year, many insurers provide significant savings, as less time on the road means a lower risk of accidents. Furthermore, the age of your vehicle and its safety features can also unlock discounts. Vehicles equipped with anti-lock brakes, airbags, and other advanced safety technologies typically come with better rates. Lastly, don’t forget to check for discounts tied to affiliations, such as being a member of certain organizations or having a profession that qualifies you for reduced rates.