The Ultimate Guide to Audio Experience

Explore insights and reviews on the best audio gear.

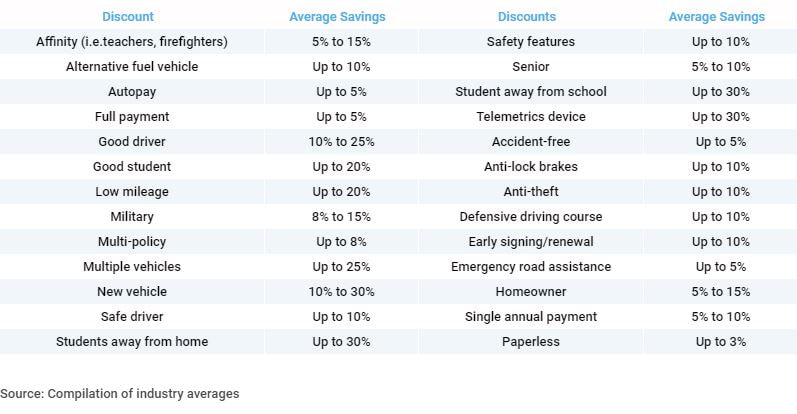

Your Wallet Will Thank You: Auto Insurance Discounts

Unlock savings on auto insurance! Discover must-know discounts that will leave your wallet happier than ever. Don't miss out!

Top 10 Auto Insurance Discounts You Might Be Missing Out On

Auto insurance can be a significant expense, but did you know there are numerous discounts available that you might be missing out on? Driving safely is often rewarded with lower premiums, but that's just the tip of the iceberg. Many insurance companies offer discounts for a variety of reasons, including bundling your policies, having a good credit score, or even just being a member of certain organizations. In this post, we'll explore the Top 10 Auto Insurance Discounts that you should be aware of to help lower your costs.

- Good Driver Discount: Drivers with a clean driving record typically receive lower rates.

- Multi-Policy Discount: Bundling auto insurance with home or other policies can lead to significant savings.

- Age-Specific Discounts: Younger drivers and seniors may qualify for special discounts.

- Low Mileage Discount: If you drive less than average, some insurers will reward you with lower rates.

- Safety Features Discount: Having modern safety features in your car can lower your premiums.

- Pay-in-Full Discount: Paying your premium in full can save you money over monthly payments.

- Student Discount: Good students may get discounts based on GPA.

- Military Discount: Active-duty service members often receive discounts on their auto insurance.

- Claim-Free Discount: If you haven’t made a claim in a certain period, you may qualify for this discount.

- Defensive Driving Course Discount: Completing a certified driving course can also provide some savings.

How to Qualify for Safe Driver Discounts: Tips to Lower Your Premiums

Qualifying for safe driver discounts can significantly reduce your car insurance premiums. Insurance companies typically offer these discounts to drivers who demonstrate responsible driving habits. Here are some effective tips to help you qualify:

- Maintain a clean driving record by avoiding accidents and traffic violations.

- Complete a defensive driving course to enhance your skills and show your commitment to road safety.

- Age and experience can play a role, so be sure to inquire if your longevity with a clean record helps in securing discounts.

In addition to the above strategies, consider the following to maximize your chances of receiving safe driver discounts:

- Bundle your auto insurance with other policies, as insurers often reward loyalty.

- Review your coverage annually and speak with your agent to ensure you're getting all available discounts.

- Utilize technology by monitoring apps or devices that track your driving behavior and show your commitment to safe driving.

By following these tips and demonstrating your safe driving habits, you can enjoy lower premiums and peace of mind on the road.

Are You Taking Advantage of Bundling Discounts for Your Auto Insurance?

Are you aware of the benefits of bundling discounts for your auto insurance? Many policyholders overlook this valuable cost-saving opportunity that can provide substantial savings on their premiums. By combining your auto insurance with other types of insurance, such as homeowners or renters insurance, you may qualify for discounts that could significantly reduce your overall expenses. According to industry statistics, bundling can save you anywhere from 5% to 25% on your premiums, allowing you to allocate those extra funds elsewhere.

In addition to the financial benefits, bundling discounts can simplify your insurance management. Instead of juggling multiple policies from different providers, you can streamline your coverage under a single insurance company. This not only makes it easier to track payments and renewals, but it also enhances your customer experience through consolidated support and services. To determine if bundling is right for you, consider comparing the total costs of separate policies versus a bundled option, and consult with your insurance agent to review your coverage needs.