The Ultimate Guide to Audio Experience

Explore insights and reviews on the best audio gear.

Insurance Policies: A Game of Risk and Reward

Unlock the secrets of insurance policies! Explore how to balance risk and reward for smarter financial decisions. Click to learn more!

Understanding the Basics: What You Need to Know About Insurance Policies

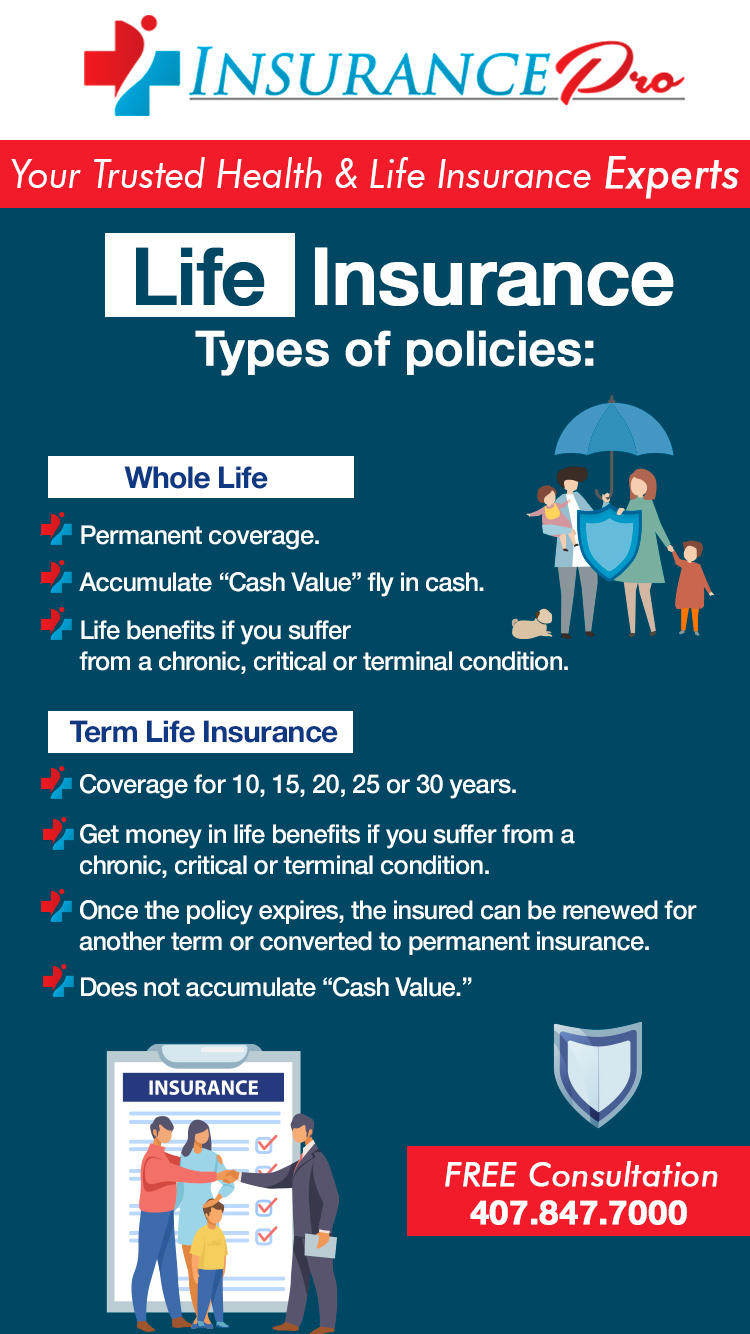

Understanding insurance policies is essential for anyone who wants to protect their assets and secure their financial future. There are several key types of insurance policies available, each designed to cover specific needs. These include health insurance, which helps manage medical expenses; auto insurance, which protects against vehicle-related incidents; and homeowners insurance, safeguarding your property from damage or theft. Additionally, life insurance can provide financial support to your loved ones in the event of your untimely passing. It is crucial to evaluate what types of coverage suit your circumstances before committing to a policy.

When choosing an insurance policy, it is important to consider factors such as premium costs, which are the regular payments you make to maintain coverage, and deductibles, which are out-of-pocket expenses you must pay before your insurance kicks in. Thoroughly reading the terms and conditions of a policy helps you avoid unexpected issues later on. Remember to consult with insurance agents or financial advisors who can provide insights and help tailor a policy that meets your needs and budget. By understanding the basics of insurance policies, you empower yourself to make informed decisions and ensure adequate protection for you and your loved ones.

Risk vs. Reward: How to Choose the Right Insurance Policy for You

Choosing the right insurance policy involves weighing the risk against the reward. To begin, it's essential to assess your personal and financial situation. Start by identifying your needs: consider factors such as your health, lifestyle, and any assets you wish to protect. For instance, if you own a home or have valuable belongings, homeowners or renters insurance will help mitigate potential losses. On the other hand, if you're young and healthy, you might opt for a basic health insurance plan instead of an extensive one. This way, you’re managing potential risks while balancing costs effectively.

Once you've assessed your needs, it's vital to compare different policies and understand their coverage as well as premium costs. Use a checklist to compare the following points:

- Deductibles: The amount you pay before your insurance coverage kicks in.

- Coverage limits: The maximum amount your insurance will pay for a covered claim.

- Exclusions: Conditions or situations that the policy does not cover.

By weighing these aspects, you’ll be in a better position to make an informed decision that aligns with your risk tolerance while maximizing potential rewards.

Common Myths About Insurance Policies: Debunking Misconceptions and Making Informed Choices

When it comes to insurance policies, there are numerous myths that can lead to confusion and poor decision-making. One of the most prevalent misconceptions is that insurance is unnecessary if you’re healthy or young. Many people believe that their current health and youthfulness shield them from risks and that they can avoid the expense of premiums. However, unexpected events such as accidents or sudden illnesses can occur at any age, making insurance a crucial safeguard for financial stability. By debunking this myth, consumers can prioritize their long-term financial health and make informed choices about their policy options.

Another common myth is that all insurance policies are the same, leading many to settle for the first option they encounter. In reality, insurance policies vary widely in terms of coverage, exclusions, and costs. It's essential to understand that each policy can affect your financial protection differently. For instance, some may offer comprehensive coverage for specific circumstances while others may include gaps that can leave you vulnerable. To make informed choices, potential policyholders should conduct thorough research, compare multiple options, and read the fine print to ensure they select a policy that best fits their unique needs.