The Ultimate Guide to Audio Experience

Explore insights and reviews on the best audio gear.

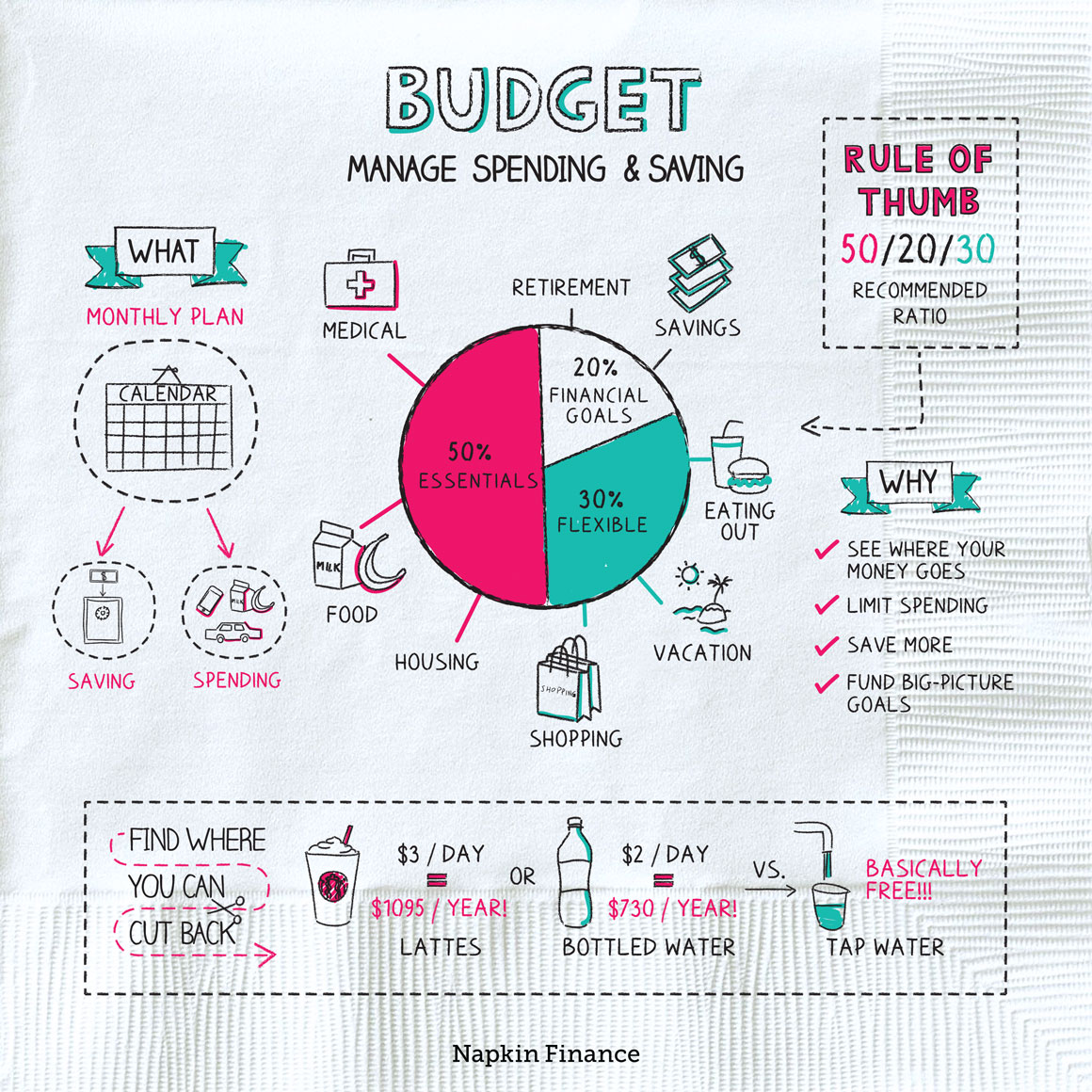

Budgeting Like a Pro: The Secret Life of Your Wallet

Unlock the secrets to mastering your finances! Discover budgeting tips that will transform your wallet from average to extraordinary.

5 Essential Tips for Mastering Your Budgeting Skills

Mastering your budgeting skills can lead to financial stability and peace of mind. To get started, consider implementing these 5 essential tips that will help you take control of your finances:

- Set Clear Goals: Before you start budgeting, define what you want to achieve. Whether it's saving for a vacation, paying off debt, or building an emergency fund, having clear objectives will keep you motivated.

- Track Your Expenses: Keep a detailed record of all your expenditures for at least a month. This practice will give you insight into your spending habits and identify areas where you can cut back.

Once you've laid the foundation for effective budgeting, the next steps will help solidify your skills:

- Create a Budget Plan: Allocate your monthly income to different categories such as housing, food, and entertainment. The 50/30/20 rule is a popular method where you spend 50% on needs, 30% on wants, and save 20%.

- Review and Adjust: Regularly review your budget to ensure it aligns with your goals. Life changes, and your budget should be flexible enough to adapt to new circumstances.

- Stay Disciplined: Finally, stick to your budget as closely as possible. It can be tempting to overspend, but maintaining discipline is key to mastering your budgeting skills.

If you're looking for great sound quality without breaking the bank, check out our list of the Top 10 budget earbuds. These options provide excellent performance and comfort, making them perfect for everyday use. Whether you're commuting, exercising, or just relaxing at home, you'll find something that fits your needs and budget.

The Ultimate Guide to Tracking Your Spending: Tools and Techniques

Tracking your spending is essential for anyone looking to manage their finances effectively. By identifying where your money goes, you can make informed decisions about budgeting and saving. To get started, you can use a variety of tools and techniques. Here are some popular options:

- **Budgeting Apps**: There are several apps like Mint and YNAB (You Need a Budget) that automatically track your spending by linking to your bank accounts.

- **Spending Journals**: If you prefer a hands-on approach, maintaining a spending journal can be effective. Write down every expense daily to gain awareness of your spending habits.

- **Spreadsheets**: For those who enjoy working with numbers, creating a personalized spreadsheet allows for detailed tracking and categorization of your expenses.

Once you've selected your preferred methods, consistency is key. Make it a habit to review your expenses regularly—commit at least once a week to revisit your budget and spending reports. Additionally, consider setting spending limits for different categories, such as groceries, entertainment, and transport, to ensure you are living within your means. Finally, don't forget to assess your financial goals. Keeping your long-term objectives in mind can help motivate you to stick to your spending plan and achieve financial freedom.

How to Create a Budget That Actually Works: Common Mistakes to Avoid

Creating a budget that actually works requires careful planning and an understanding of common pitfalls. One major mistake people often make is underestimating monthly expenses. To avoid this, start by tracking all your spending for at least a month. This will give you a clear picture of where your money is going and help you categorize your expenses into fixed, variable, and discretionary. Additionally, be aware of hidden costs, such as annual subscriptions or infrequent bills, which can derail your budget if not accounted for.

Another common mistake is setting unrealistic goals. Overly ambitious budgeting can lead to frustration and ultimately abandonment of the plan. Instead, focus on creating a budget that is both realistic and flexible. This means allowing for some variability in your income and expenses. A good practice is to use the 50/30/20 rule, where you allocate 50% of your income to needs, 30% to wants, and 20% to savings or debt repayment. By making these adjustments, you can design a budget that not only works but also empowers you to reach your financial goals.