The Ultimate Guide to Audio Experience

Explore insights and reviews on the best audio gear.

Crypto Regulation Updates: What You Didn't Know Could Affect Your Wallet

Unlock the secrets behind crypto regulation changes that could impact your wallet! Stay informed to protect your investments.

Understanding the Latest Crypto Regulations: Key Changes That Could Impact Your Wallet

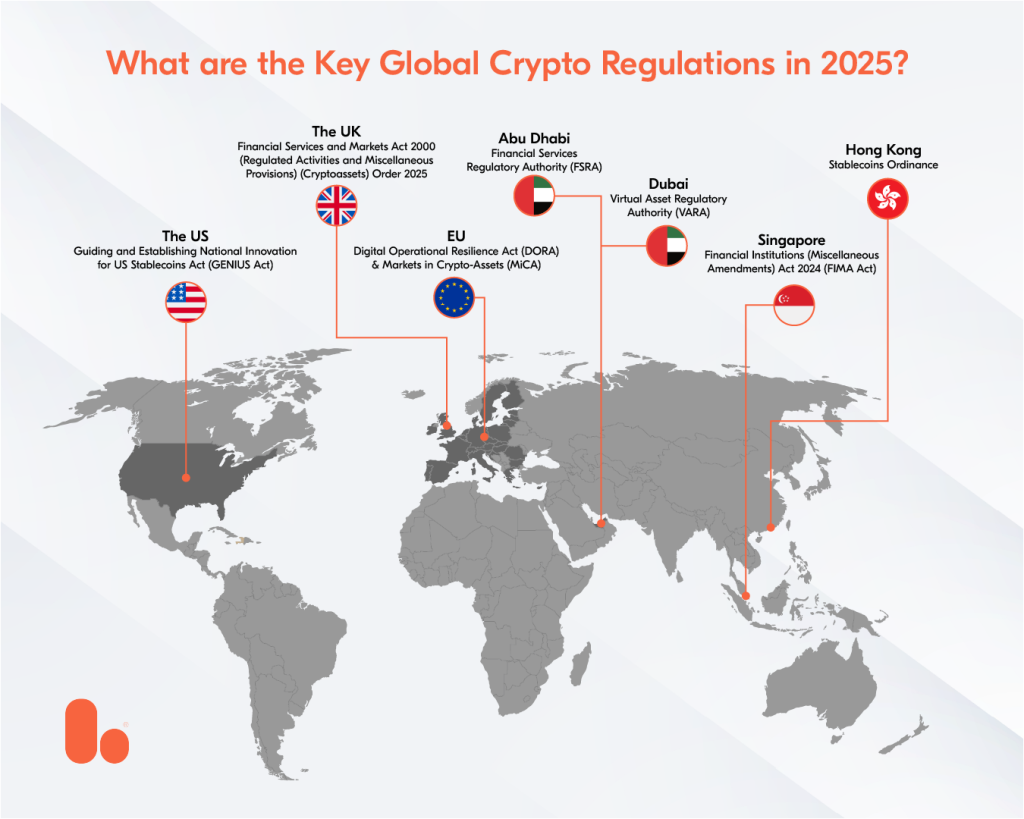

In recent months, the landscape of cryptocurrency regulations has undergone significant changes that could directly impact your wallet. As countries around the world grapple with the rise of digital currencies, regulators are implementing new frameworks to ensure investor protection and market stability. Understanding the latest crypto regulations is crucial for anyone involved in buying, selling, or holding cryptocurrencies. Key developments include stricter know-your-customer (KYC) requirements and the classification of certain tokens as securities, which may require companies to register with regulatory bodies. These changes aim to curb fraud and enhance the legitimacy of the crypto market.

Additionally, tax regulations are evolving to account for the unique attributes of cryptocurrencies. Governments are increasingly keen on taxing crypto transactions, meaning that you could be liable for capital gains taxes even on small trades. For instance, in the United States, the IRS has clarified its stance on reporting crypto earnings, urging taxpayers to report any gains or losses accurately. Being aware of these regulatory shifts not only helps you navigate potential legal pitfalls but also allows you to strategize your investments in a manner that aligns with current laws, ultimately safeguarding your wallet from unexpected penalties.

Counter-Strike is a highly popular first-person shooter game that has shaped the esports landscape since its initial release. Players engage in team-based combat, often focusing on objectives such as bomb defusal or hostage rescue. For those looking to enhance their gaming experience, using a betpanda promo code can provide added benefits and rewards.

5 Surprising Ways Regulatory Shifts Can Affect Cryptocurrency Prices

Regulatory shifts can have a profound impact on cryptocurrency prices, often in ways that are not immediately apparent. For instance, when a country implements stricter regulations or bans on cryptocurrency trading, it can lead to a panic sell-off. Investors, fearing loss and uncertainty, may rush to liquidate their assets, causing a sharp decline in prices. Conversely, when a government introduces favorable regulations or clarifies its stance on digital currencies, it can instill confidence in the market, leading to a surge in demand and, ultimately, prices. The balance between regulation and market sentiment is delicate and can shift rapidly.

Moreover, regulatory changes can also influence cryptocurrency prices through the introduction of new competition. For example, if a regulatory body grants licenses to new blockchain startups, it could increase market competition, leading established coins to either innovate or face declining market shares. Such competitive dynamics can have varying effects on prices, as older cryptocurrencies may experience pressure to prove their value in light of innovative newcomers. Therefore, investors must pay close attention to legislative developments, as the impact on cryptocurrency prices can be both surprising and significant.

Are You Prepared? How New Crypto Regulations Might Change Your Investment Strategy

As the landscape of cryptocurrency continues to evolve, **new regulations** are being introduced that could significantly impact your investment approach. Understanding the nuances of these regulations is crucial for any investor looking to protect their assets and maximize potential returns. For instance, regulatory bodies may impose stricter **KYC (Know Your Customer)** and AML (Anti-Money Laundering) requirements, which could necessitate adjustments in how you buy, sell, and store your cryptocurrencies. Being proactive in your research will not only keep you compliant but also help you identify opportunities within this shifting framework.

Furthermore, the potential implications of these regulations on market sentiment and pricing cannot be overlooked. As new rules are implemented, certain coins might experience volatility as traders react to the news. It's essential to evaluate your risk tolerance and be prepared with strategies such as diversification or holding assets long-term to weather market fluctuations. By staying informed and adapting your **investment strategy** to align with the changing regulatory landscape, you can enhance your chances of success in the dynamic world of cryptocurrency.